wisconsin 1st time home buyer grants

Grants of up to 5000 are available for a home purchase in the City of Milwaukee. 5 rows Wisconsin first-time home buyer grants WHEDA doesnt offer grants.

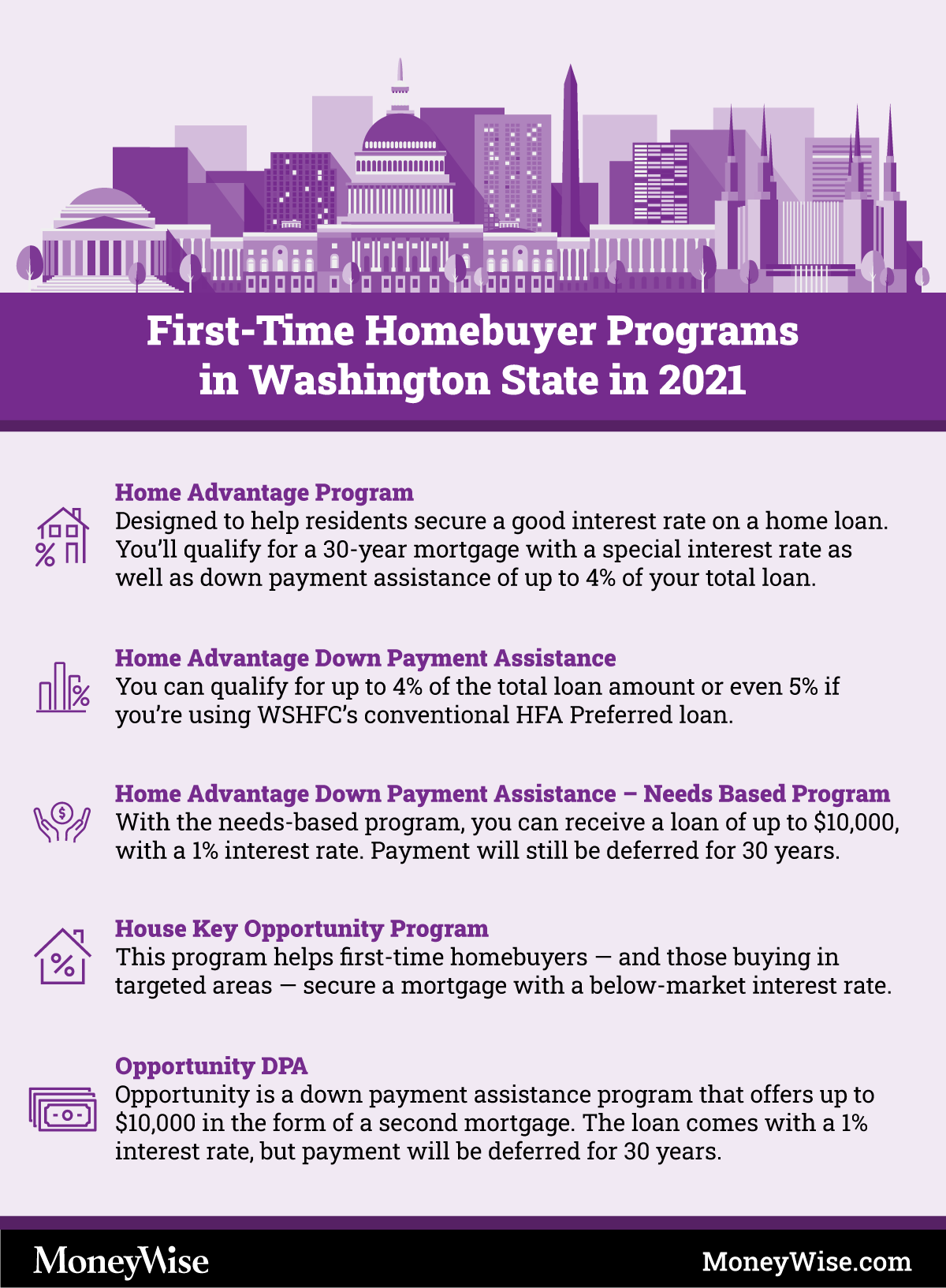

First Time Homebuyer Programs In Washington State 2022

Ad 1st Time Home Buyers.

. It can be challen. Must meet WHEDA purchase price limits if a first-time homebuyer 294600 for a single-family home and 377219 for a two- to four-unit home outside of a Target Area. 1 day agoThis program offers down payments as low as 100 and requires a credit score as low as 500-580.

Dont Settle Save By Choosing The Lowest Rate. That was 20 higher than a year earlier. Heres How to Simplify Your Search For a Great Mortgage Rate.

If you want to buy a more expensive home and have the income to qualify jumbo. Grants have a lifetime. The Easy Close Advantage program has a low-cost fixed interest rate with immediate access to loan funds at the time of closing.

Ad Learn About Our Community Homeownership Commitment Today. Full title service is required if the total outstanding balance on Section 504 loans is greater than 25000. This program is designed for borrowers who want a conventional loan.

Ad 2022s Latest Online Mortgages. Downpayment Plus is a grant assistance program offered throughout Wisconsin that was made to make home buying easier and more affordable for first time buyers. According to the latest research with an average household income of 5209400 per.

These programs provide down payment andor closing cost assistance in a variety of forms including. To be eligible you must be a first-time homebuyer at or below 80 percent of your countys AMI. A program to assist low-to-moderate income first-time homebuyers no home ownership in last 3 years purchase a single-family home.

Instead it provides. You can lookup the 2022 conforming loan limits for your county using this conforming loan limits calculator. NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

The program also grants borrowers free access to. Billings first-time home buyers. Department of Housing and Urban Development 451 7th Street SW Washington DC 20410 T.

Get All The Info You Need To Choose a Mortgage Loan. Loans are termed for 20 years. The Federal Housing Administration allows down payments as low as 35 for those with.

Both home prices and home price inflation are well below national averages. Grant programs for first-time homebuyers are available in Wisconsin cities and counties. Wisconsin residents can fully finance their homes.

You must agree to live in US Department of Housing and Urban Development. Your loan is forgiven at the five-year mark. The down payment is the one thing that separates many first-time homebuyers from making the leap and purchasing a home.

Instead it offers two types of down payment assistance DPA loans to qualified. First time home buyers in Wisconsin can qualify for down payment loans with as little as 0 interest. To stimulate the states economy and improve the quality of life for Wisconsin residents by providing affordable.

Find Out How With Quicken Loans. Ad Own A 150000 Home With A 4500 Down Payment. Choose The Loan That Suits You.

Department of Housing and Urban Development. Property must be located in Wisconsin. Get Funding for Rent Utilities Housing Education Disability and More.

Ad Get Funding for Rent Utilities Housing Business Disability and More. Of course saving for your down payment and getting a home loan can still be a challenge. Loan interest rate is fixed at 1.

Comparisons Trusted by 45000000. Wisconsins local government has set aside financial assistance for residents with no or low-income. WHEDA is mission-based and our mission is simple.

WHEDA does not provide financial assistance. TheWisconsin Housing and Economic Development Authority WHEDA is a state housing finance agency for Wisconsin. Wisconsin first-time home buyer grants.

Home-Buy the American Dream. Ad Lock Rates For 90 Days While You Research. Provided you have a minimum credit score of 620 you can qualify for a 30-year fixed-rate mortgage with.

The Homebuyer Assistance Program provides funding to help prospective homeowners rehabilitate foreclosed homes they will occupy as their primary residence. Janesville also runs a Home Improvement Program. Grants of up to 7000 are available if purchasing a home with in the Citys Community Development Block.

Your First Home is Waiting. This agency delivers a variety of homebuyer assistance programs. Do not have to be a first-time.

Must be owner-occupied for the life of WHEDA loan. Do not have to be a first-time home buyer to utilize this program. If you want to.

This is the go-to program for many first-time home buyers with lower credit scores.

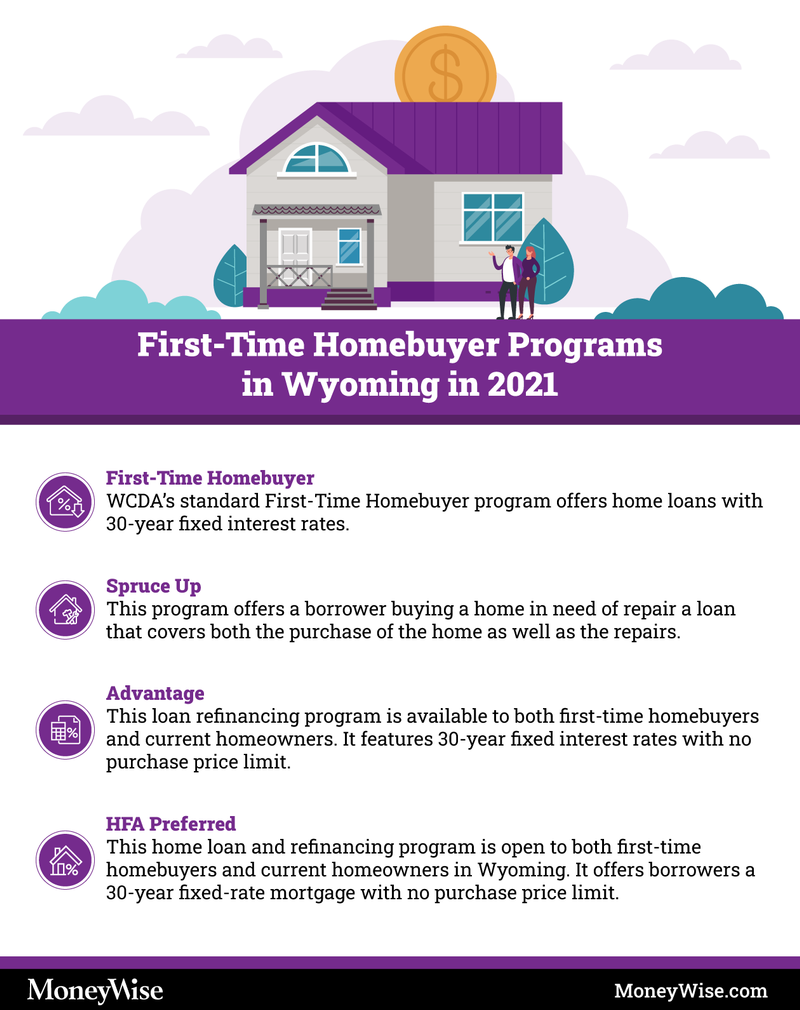

First Time Homebuyer Assistance Programs In Wyoming 2022

Pin On Real Estate Infographics

Wisconsin First Time Homebuyer Assistance Programs Bankrate

First Time Homebuyer Programs In Ohio 2022

Cti First Time Home Buyer Certificate Classes August 2013 First Time Home Buyers Home Ownership Haverhill

8 First Time Home Buyer Grants In 2022

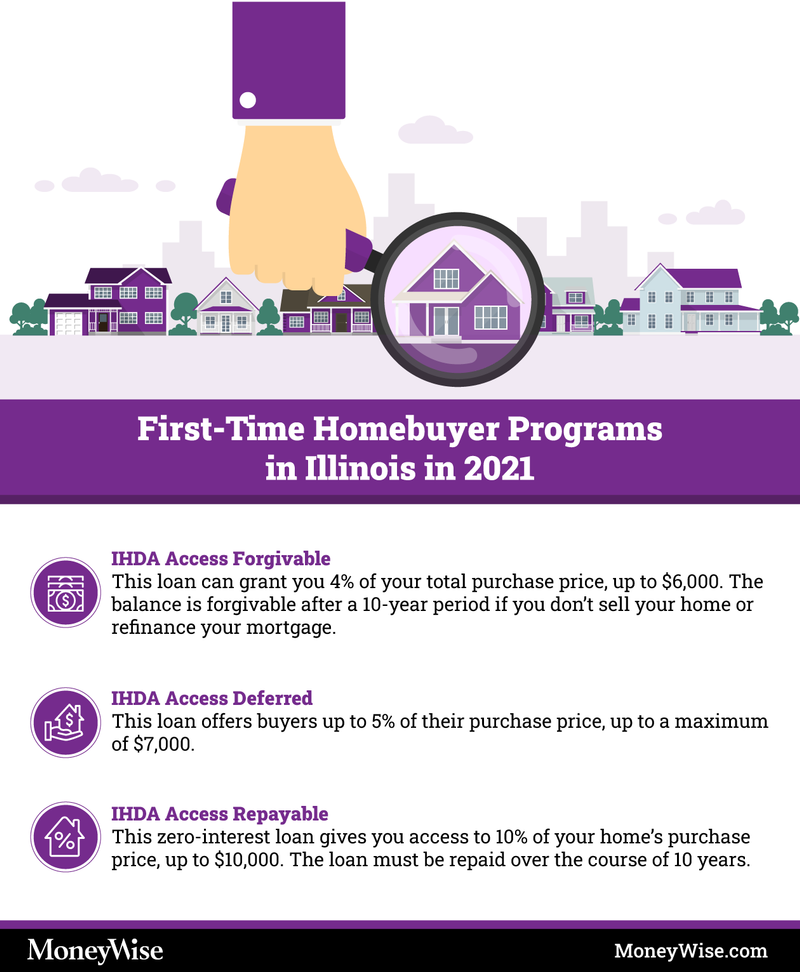

Illinois First Time Homebuyer Programs 2022

First Time Homebuyer Programs In Arizona 2022

First Time Homebuyer Grants And Programs Nextadvisor With Time

Biden S 25 000 First Time Home Buyer Program Explained Youtube

Ubhometeam Posted To Instagram Home Buying Tips For 1st Time Home Buyers 1 Tip Is To Give Us A Call 2 Home Buying Buying First Home Home Buying Tips

Best Down Payment Assistance Program Home Buyer Grants First Time Home Buyer Programs 2022 Youtube

8 First Time Home Buyer Grants In 2022

Find The First Time Home Buyers Dallas And Fort Worth Texas New Home Programs Help You Find Mortgage Grants Down First Time Home Buyers Buyers First Time

The Steps To Home Buying This Infographic Offers A Concise And Colorful Guide To The Different Stages Of Th Home Buying Process Buying Process Home Buying

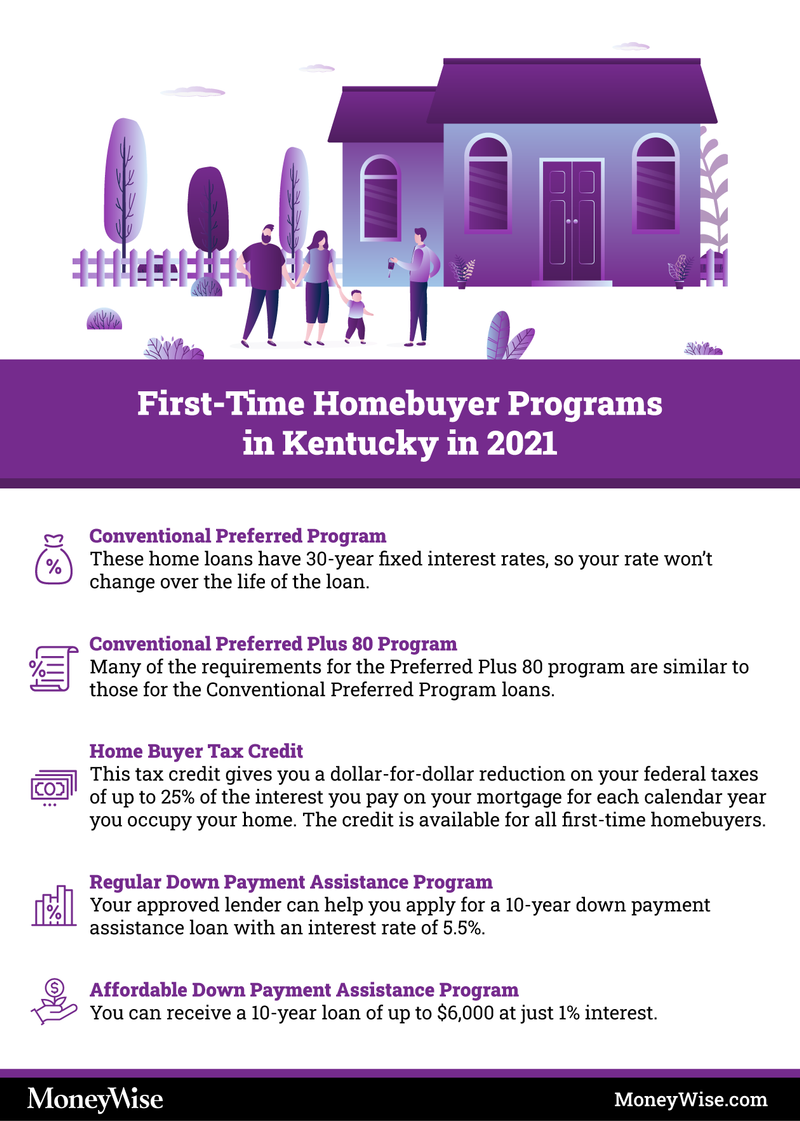

First Time Homebuyer Programs In Kentucky 2022